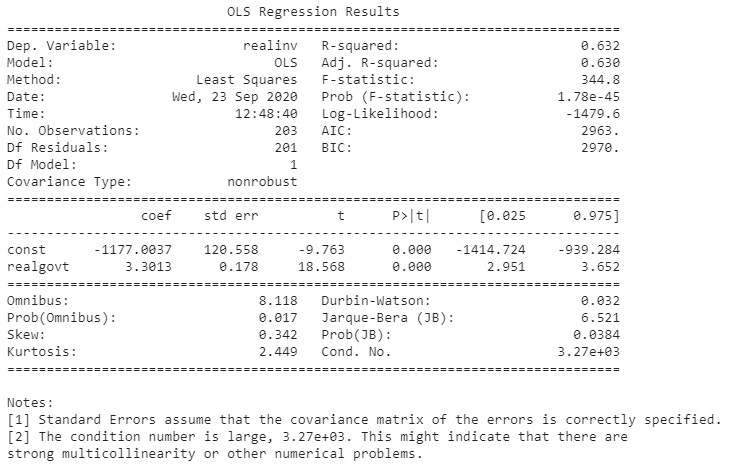

Use Linear Regression to predict gross private domestic investment from an independent variable X of federal consumption expenditures & gross investment.

Data Description Below

Number of Observations - 203

Number of Variables - 14

Variable name definitions::

year - 1959q1 - 2009q3

quarter - 1-4

realgdp - Real gross domestic product (Bil. of chained 2005 US$,

seasonally adjusted annual rate)

realcons - Real personal consumption expenditures (Bil. of chained

2005 US$, seasonally adjusted annual rate)

realinv - Real gross private domestic investment (Bil. of chained

2005 US$, seasonally adjusted annual rate)

realgovt - Real federal consumption expenditures & gross investment

(Bil. of chained 2005 US$, seasonally adjusted annual rate)

realdpi - Real private disposable income (Bil. of chained 2005

US$, seasonally adjusted annual rate)

cpi - End of the quarter consumer price index for all urban

consumers: all items (1982-84 = 100, seasonally adjusted).

m1 - End of the quarter M1 nominal money stock (Seasonally

adjusted)

tbilrate - Quarterly monthly average of the monthly 3-month

treasury bill: secondary market rate

unemp - Seasonally adjusted unemployment rate (%)

pop - End of the quarter total population: all ages incl. armed

forces over seas

infl - Inflation rate (ln(cpi_{t}/cpi_{t-1}) * 400)

realint - Real interest rate (tbilrate - infl)

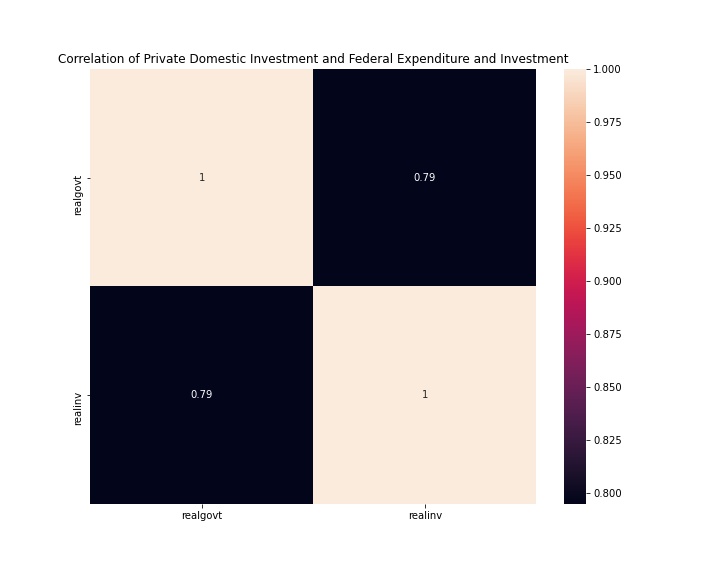

X = realgovt

y = realinv

realinv - Real gross private domestic investment (Bil. of chained

2005 US$, seasonally adjusted annual rate)

realgovt - Real federal consumption expenditures & gross investment

(Bil. of chained 2005 US$, seasonally adjusted annual rate)

-We are trying to predict private domestic investment based on government expenditure and investment.

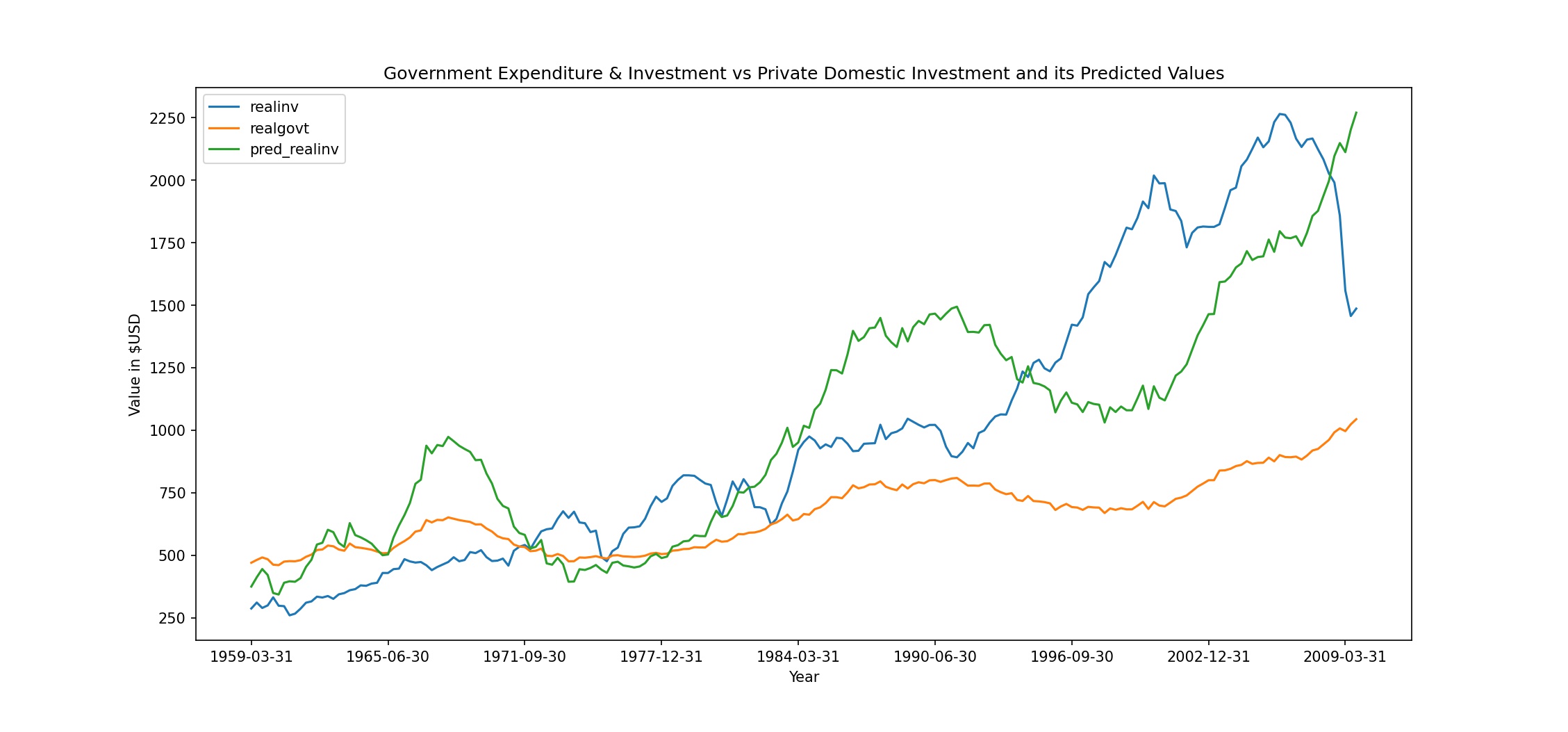

-We can see the prediction values of private domestic investment somewhat matches the curve of the actual government expenditure.

-There are varying dips in private domestic investments where there is a spike in actual government expenses.

-From the 2002 Dot-Com Bubble and the 2008 financial crash, there was a great dip in private domestic investment. However, Government Expenditure and Investments rallied on.

-The prediction values fail to capture the varying dips as they are only considering the government investment and expenditure which had a subtle increase during that period.

-The model is therefore too Linear in that it follows closely with its Independent X to predict the dependent Y inorder to get the values for the yhat.

-The linear nature of the model cannot capture the non-linear nature of real-world events like the 2002 Dot-Com Bubble and the 2008 Great Recession.

-Try and explore a non-linear model to capture the subtleties of non-linearity.

-We will explore time-series analysis as an alternative.