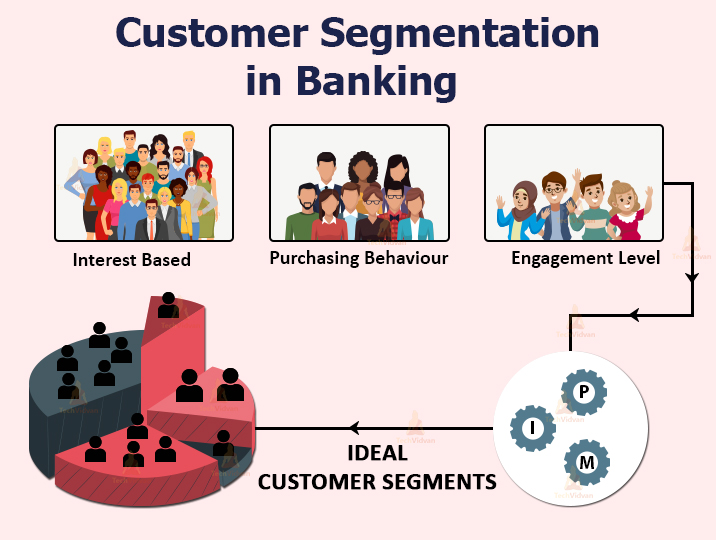

Customer segmentation is a pivotal strategy for businesses aiming to understand their customers better and tailor their services accordingly. This project employs data science techniques to segment customers based on banking and financial data. By categorizing customers into distinct groups based on shared characteristics, businesses can personalize marketing strategies, optimize product offerings, and enhance customer satisfaction.

By segmenting customers, businesses can create targeted marketing campaigns, optimize their product offerings, and enhance customer experience. This can lead to increased sales, improved customer retention, and overall business success.

- Exploratory Data Analysis (EDA): This feature allows for a deep dive into the dataset to uncover structure and patterns.

- Feature Engineering: This process involves creating new features that encapsulate meaningful information from the raw data.

- Clustering Algorithms: These machine learning algorithms are used to segment customers based on their similarities.

- Segment Interpretation and Profiling: This feature helps understand the unique characteristics and behaviors of each customer segment.

- Segment Validation and Strategy Implementation: This involves evaluating the effectiveness of the segmentation and implementing strategies personalized for each segment.

- Customer Distribution by Income Band: This provides insights into the socioeconomic diversity of customers, which can guide targeted marketing and tailored product offerings.

- Customer Distribution by Banking Type: This helps in understanding and catering to the unique needs of different banking segments, thereby enhancing customer satisfaction.

- Customer Distribution by Banking Relationship and Gender: This allows for tailoring customer experiences based on demographics within different banking relationships, fostering personalized services.

- Customer Distribution by City: This shows the geographical distribution of customers, informing location-based marketing strategies and service offerings.

- Customer Distribution by Relationship Duration: This provides insights into customer loyalty and engagement levels, enabling personalized retention strategies.

- Financial Totals by Banking Relationship: This helps in understanding financial behaviors across different banking relationships, guiding product development and pricing strategies.

Please follow the links for each library to view their respective installation guides.

We highly encourage contributions to this project! If you have ideas for improvements, new features, or bug fixes, please follow these steps:

- Fork the repository.

- Create a new branch (

git checkout -b feature/improvement). - Make your changes.

- Commit your changes (

git commit -am 'Add new feature'). - Push to the branch (

git push origin feature/improvement). - Create a new Pull Request.

This project is licensed under the MIT License.

We extend our deepest gratitude to all who have made this project possible. Our special thanks go to the OpenAI ChatGPT model and Microsoft Copilot, whose instrumental roles in debugging and refining the project’s code and documentation significantly contributed to the development of our project.

Our peers deserve our sincere appreciation for their insightful feedback and constructive critiques throughout the project's development. Their unique perspectives and experiences have been instrumental in steering our project towards its successful completion.

Lastly, we acknowledge that this project would not have been achievable without the intellectual and technical contributions of the Python community worldwide. Their groundbreaking work has opened up new possibilities, and for that, we are profoundly grateful.